Welcome Credit Friend!

Step By Step Credit Guides

-

The Credit Plug: A Guide To Repairing Your Own Credit

Regular price $53.00 USDRegular priceUnit price per -

From Renting To Buying: Steps To Become A Homeowner

Regular price $17.00 USDRegular priceUnit price per -

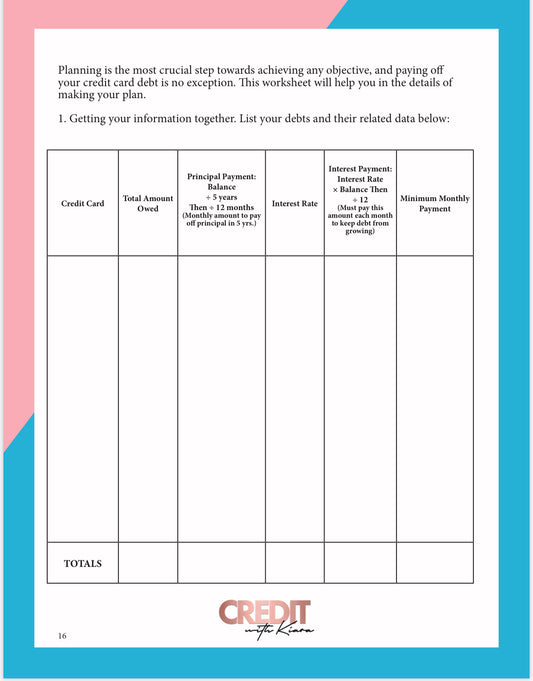

Maxed Out: How To Escape Credit Card Debt

Regular price $17.00 USDRegular priceUnit price per -

Invasion Of Privacy: Tips To Quickly Recover From Identity Theft

Regular price $26.00 USDRegular priceUnit price per -

I Need A Private Landlord: Eviction Removal Guide

Regular price $17.00 USDRegular priceUnit price per -

Step by Step Rapid Inquiry Removal Guide

Regular price $26.00 USDRegular priceUnit price per